Want a quick test of the quality of a business’s financial management? Ask their team to produce financial statements. (This always includes a Balance Sheet and Profit & Loss statement. It may also include a Statement of Cash Flow and Aging reports for Accounts Receivable (AR) and Accounts Payable (AP).) If they can’t produce these correctly, on time, and in the right format, the business has a financial management problem. In fact, the problem is so serious that obtaining a business valuation will be impossible until corrected.

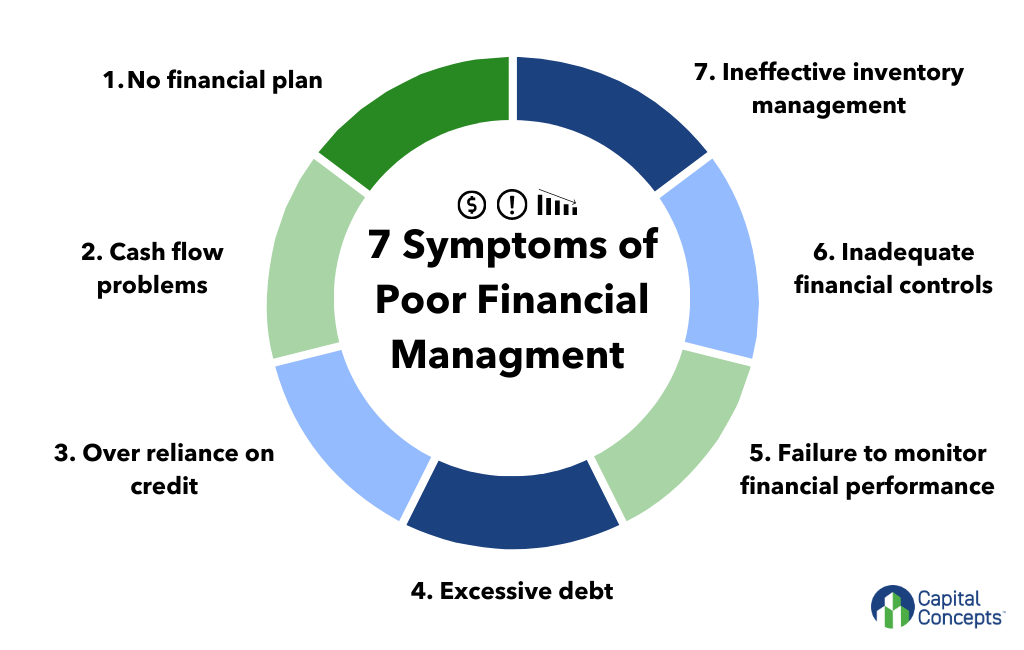

Symptoms of Poor Financial Management

Poor financial management can manifest in many ways. Seven symptoms include

- No financial plan: Your business doesn’t have a clear budget or financial plan. This makes it difficult to prioritize expenses or investments and make informed financial decisions.

- Cash flow problems: Your business consistently struggles to pay bills on time, misses payroll, or is frequently late on loan repayments.

- Overreliance on credit: Your business frequently relies on credit to cover expenses (a symptom of cash flow problems). This puts it at risk of accumulating excessive debt.

- Excessive debt: Your business carries high levels of debt and is unable to manage its debt payments. This indicates a risk of defaulting on loans or facing bankruptcy.

- Failure to monitor financial performance: You don’t regularly review and analyze financial performance, causing you to miss warning signs of financial trouble (e.g., declining revenue or rising expenses).

- Inadequate financial controls: You don’t do enough internal auditing, putting your business at risk of fraud or other financial improprieties.

- Inefficient inventory management: You struggle to manage your inventory effectively. Your business experiences excessive inventory costs, inefficient use of storage space, and difficulties meeting customer demand.

Improving Financial Management

Business owners are not generally experts in finance. They’re engineers, outstanding salespeople, marketing experts, etc. They aren’t familiar with financial vocabulary and don’t enjoy financial conversations. Even those who do have a background in finance are usually working in a different area of finance. They need assistance from people with working knowledge of how to do the nuts and bolts of managing a company’s books.

Every business owner needs to appreciate the value and relevance of financial reports, and they need professionals to handle this critical component of the business. While it’s an investment to bring in accounting and finance professionals to update your business’s books, reconcile accounts, and keep accounts receivable and payable current, your return will be exponential in the long run.

Buyers and brokers insist on a detailed and organized record of the business’s financial transactions. Income, expenses, cash flow, and other financial metrics are critical to understanding the business’s financial performance. These are also essential components of your business’s valuation and the sale price you can expect.

Five Ways Financial Management Improves A Business’s Value

Beyond the basics of keeping records up to date, finance professionals can also assist businesses to improve their profitability and growth. Financial planning is critical to the success of any business. This remains true regardless of a business’s size or industry or whether the owner’s exit is imminent or not. Planning includes:

- Setting goals and priorities: Identifying short-term and long-term goals helps owners prioritize financial resources. It also helps them make more informed decisions about where to invest resources and which opportunities to pursue.

- Budgeting and forecasting: Creating budgets and financial forecasts helps a business manage its cash flow and plan for the future. By creating a budget, owners can better manage the business’s expenses and identify areas to reduce costs or increase revenue.

- Identifying risks and opportunities: Anticipating potential risks and opportunities allows owners to avoid negative impact on your business’s financial performance. You can take proactive measures to mitigate risks and capitalize on opportunities.

- Supporting decision-making: Your plan creates a framework for decision-making by providing accurate and up-to-date financial data that you can use to evaluate the pros and cons of different options.

- Facilitating funding and investment: Financial planning helps you present a clear and compelling financial picture to potential investors, lenders, or other funding sources. This can support positive cash flow by improving your ability to secure funding and investment.

Why Clean Up Your Books

Prospective buyers know that messy books mean messy businesses, and “figuring it out as we go” isn’t a business strategy. Strong and successful business owners insist on effective financial management. They hire professionals to help them manage their financial resources, identify risks and opportunities, and make more informed decisions about their future growth and success. And when they go to sell, financial issues do not derail the process or reduce their business’s valuation!

Visit our blog, Capital Concepts Insights, to read additional articles in our series on exit planning.

Related Articles

Get A Grip Roundtable

Does This Sound Familiar? Your business isn't as efficient or profitable as you'd like. You’re putting in the hours but not seeing the results you want. You’re stuck. You know your business has potential, but you're unsure how to take it to the next level. You’re...

Build & Beware: What it might cost you to sell your business

You Just Sold Your Business for Millions – So Why Isn’t That in Your Bank Account? The papers are signed. The deal is closed. After years of hard work, you’re ready to celebrate your big payday. But as you finalize accounts and tie up loose ends, you realize the...

Navigating Payroll Taxes

Tax deadlines are creeping up, demanding your attention and time. You’re still busy making sure things run smoothly day-to-day; filing business taxes can feel like the last complication you want to deal with.