Unlock the secrets of effective goal-setting with this guide on “How To Set Good Goals That Build Your Business.” We all know the truisms like, “Failing to plan is planning to fail,” and so on. But the intellectual understanding of something is completely different from doing it. We put together a list of questions to ask yourself and areas of your business to examine so that your plan and goals for the next year are sound.

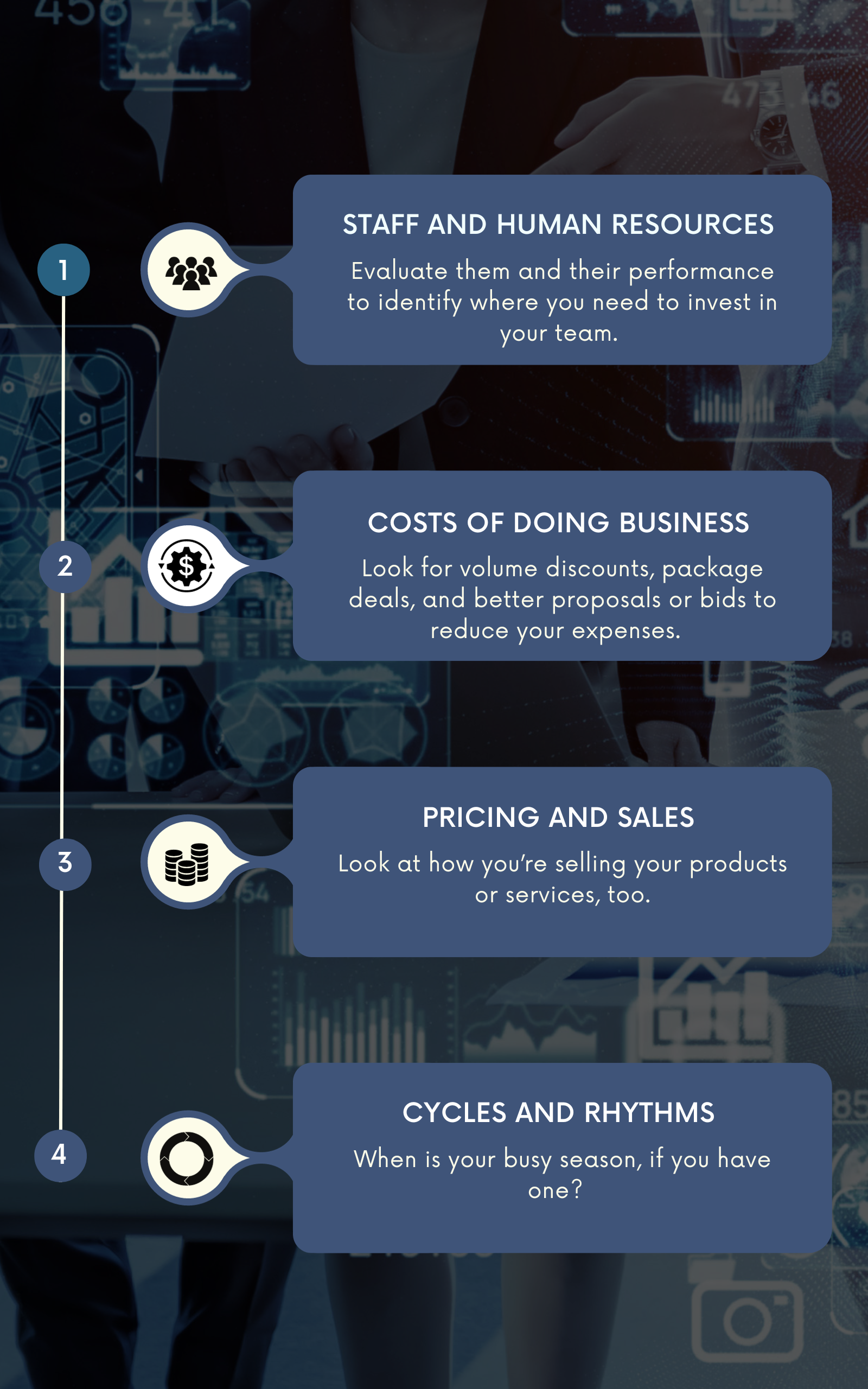

Staff and Human Resources

Look at your personnel. Evaluate them and their performance to identify where you need to invest in your team.

- Who is performing above and beyond?

- Who do you need to coach?

- Where do you need to hire?

- Who needs professional development? In what areas?

With this information, start budgeting the funds. You’ll need this make a new hire, invest in training or other professional development, offer raises or promotions, and expand or shift benefits so that you can retain the individuals you need to keep growing and improving as a company.

NOTE: We recommend bringing on a fractional CFO when your sales climb past half a million per year. This financial expert will be an invaluable resource during planning and goal setting. Contact us to learn more about how a fractional CFO can help you scale up.

Costs of Doing Business

If your business makes large purchases of raw materials, supplies, or services, review your suppliers and vendors. Look for volume discounts, package deals, and better proposals or bids to reduce your expenses.

If you run a smaller business, look ahead and plan purchases when the pricing is best. Some tips for this include:

- If a product or service is marked down once or twice a year, prepare ahead to buy it at that best price.

- Set aside the funds to pay in full for SAAS subscriptions and products you know you’ll use.

- Review subscriptions each year to identify and remove any duplicates, subscriptions you no longer need, or sneaky renewals you overlooked.

Pricing and Sales

- Are you charging enough for your products or services? Do some benchmarking with competitors in your market. You want to avoid being the cheapest (unless you’re in a pure commodity business). You also want to avoid being the most expensive, unless you have a unique differentiator that justifies a high price tag (e.g. Apple).

- Look at how you’re selling your products or services, too. Can you repackage them in a way that is more profitable? Look at options that either cost you less to sell or add value that allows you to charge more.

Cycles and Rhythms

As you set goals for the numbers of customers acquired, products sold, dollars earned, people hired, and more, take any yearly rhythms into account.

- Is your business seasonal, with predictable highs and lows?

- When is your busy season, if you have one?

- Do you need to implement any vacation policies to reduce the negative effect on sales or utilization of multiple people vacationing at the same time?

How Will You Measure Progress?

A goal might be one that will drive your business growth. But if you can’t measure it using the data you have, it isn’t the most effective goal. Be sure to share your plan and goals with your team. You’ll need to discuss how to measure each one, get their buy-in, and assign ownership so that you know everyone is working towards the same thing.

In addition to consulting your financial advisor or CFO, you may need input from an operations or sales expert. Some goals are financial and others are operational, or have an operations component.

At Capital Concepts USA, we have financial, marketing and sales, and operations consultants who can work with you to craft a plan and set goals that will make a difference in your business. Contact us today for a free 15-minute call with our founder, Lorne Greenfield.

Related Articles

Five Ways Financial Management Improves Your Business’s Value

Poor financial management can manifest itself in many ways, but the price is always the same: the value of your business.

Odds are, as the owner of your business you are a strategist, visionary, and leader. But you likely don’t have the bandwidth to manage the complexities of your business’s finances.

But not to worry! We’ve outlined 5 ways financial management will improve your business’s value.

How To Avoid the Biggest Valuation Mistake Made by Business Owners

You’ve been working on the sale of your business for months now. All the work, not just to complete this sale but to build a business someone else actually wants to buy, is about to pay off.

You hold your breath as the sales agent slides a piece of paper across the desk towards you…with a number completely different than you’d negotiated!

“As you know, we did a final business valuation last week to determine the final sale price for the closing today,” she explains. “After reviewing all of your records, we have determined that the value decreased from our initial estimate a year ago. As a result, the sale price will be 25% lower than we originally planned.”

What happened to the profitable sale you worked so hard for?!

What To Do If Your Business’s Valuation Is Too Low

You’ve decided to create an exit plan, and now it’s time to find out how much your business is worth. What if the value comes in lower than you expected? In this week’s Insights article, we talk about common issues that contribute to a low business valuation and how to move forward.

Need Fresh Eyes On Your Business?

We offer complementary consultations to help you identify the areas where you could most quickly and easily improve your business’s performance, value, and profitability. Request one today.