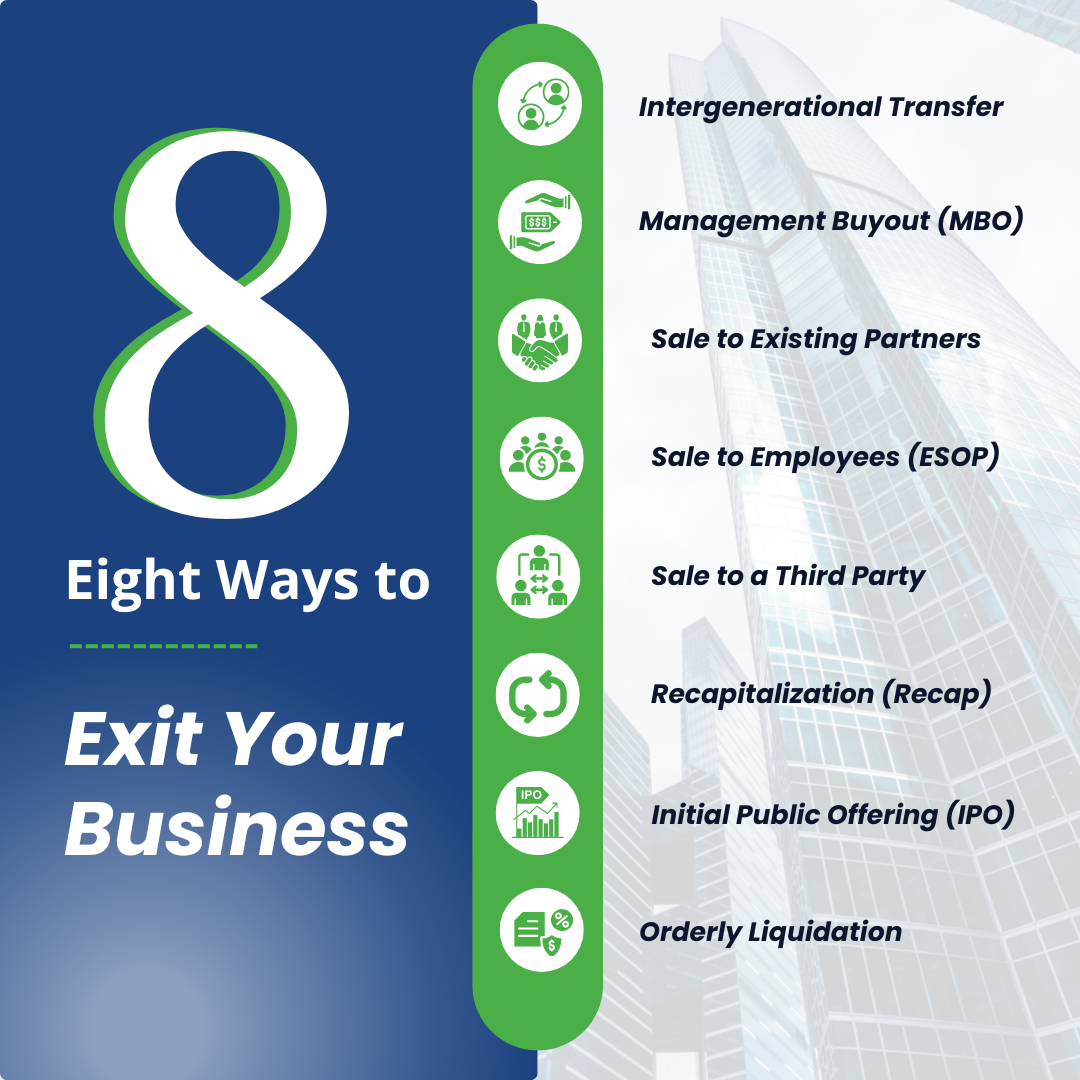

When it comes to exiting a business, most people assume there is only one way out: sale. But actually, there are 8 distinct ways to exit a business.

Before considering your next move, it’s crucial that you understand each of these options to determine which is best for you!

In this article, we’re giving you an overview of the top 8 ways to exit a business: Intergenerational Transfer, Management Buyout (MBO), Sale to Existing Partners, Sale to Employees (ESOP), Sale to a Third Party, Recapitalization (commonly referred to as “Recap”), Initial Public Offering (IPO), and Orderly Liquidation.

1. Intergenerational Transfer

This strategy involves handing off ownership to a relative. Businesses are more than just their profitability — they represent the relationships, years of hard work, and dedication it takes to build successfully. Because of this emotional investment, you may want to consider exiting your business by transferring ownership to a family member. This retains its legacy!

It’s important to research the unique tax liabilities that come with this option. Depending on how your financing is arranged in your exit plan, there are several options to pursue. Learn more here.

2. Management Buyout (MBO)

Another viable option is a Management Buyout (MBO), where the existing management team purchases the business from its current owners.

This approach has countless benefits, including continuity in leadership, since those intimately familiar with the company’s operations take the helm.

If you’re looking for a smooth transition with lower risk, an MBO might be a good option for you. Your management team likely already possesses a deep understanding of the company’s strengths, weaknesses, and potential areas for growth. This knowledge can shield the business from any dramatic negative changes after the transition, providing a sense of stability for employees and stakeholders.

However, executing a successful MBO requires careful planning, financial diligence, and negotiation skills to ensure a fair deal for both parties involved.

3. Sale to Existing Partners

This approach involves selling your ownership stake in the company to current partners or co-owners. Similar to an MBO option, selling to existing partners allows you to positively leverage the familiarity and trust already established within the partnership.

Existing partners are often well-acquainted with the business’s operations, culture, and potential for growth, which can streamline the sale process and mitigate potential disruptions.

Learn more about the tax implications of this option here.

3. Sale to Employees (ESOP)

The fourth option is Sale to Employees, often facilitated through an Employee Stock Ownership Plan (ESOP). This strategy not only provides an avenue for the founder to exit while preserving the company’s legacy, but also empowers employees by granting them ownership stakes.

Selling to employees through an ESOP can foster a sense of loyalty, engagement, and motivation among staff, as they become personally invested in the company’s success.

You’ll want to make sure that you’re aligning the interests of your employees during this transition period. Plan to collaborate closely with these new leaders as you equip them to take over your business!

5. Sale to a Third Party

Selling to a third party is one of the most popular ways to exit a business. According to data from BizBuySell, a leading online marketplace for small business sales, the median sale price of businesses sold to third-party buyers in the United States increased by 3.2% in the first quarter of 2023 compared to the same period in the previous year. Selling is often a preferred method of exiting because of the stability it offers, as well as the potential financial reward.

When approaching sale conversations, be sure to do your research on median market values for the product or services you offer so that you’re armed with knowledge!

And as with exiting your business through an internal hand-off, external sales should be considered carefully to make sure both parties benefit from the transition.

6. Recapitalization (Recap)

Recapitalization (Recap) is a strategic option for business owners wanting to realize value while retaining a stake in their enterprise.

This approach involves bringing in outside investors who inject capital into the business, often in exchange for equity or debt securities.

Recapitalization deals constituted a significant portion of private equity activity, with over 2,500 transactions recorded in 2021 alone.

Recapitalization can also positively impact employee engagement and retention during the exit process. Research indicates that employee-owned companies, often facilitated through Recapitalization, tend to outperform their counterparts in terms of productivity and profitability.

7. Initial Public Offering (IPO)

Initial Public Offering (IPO) involves offering shares of the company to the public for the first time, which then unlocks access to capital markets (and potential liquidity for existing shareholders).

According to data from Renaissance Capital, global IPO activity remained strong in 2023, with over 1,300 IPOs raising a total of $485 billion in proceeds. This was a notable increase compared to the previous year, highlighting the continued investor appetite for newly public companies. Furthermore, an analysis by Ernst & Young (EY) reveals that IPOs in the technology sector alone delivered impressive returns, with an average first-day gain of 35% in 2023.

If you decide to go public with your business sale, be sure to plan thoroughly, comply with regulatory requirements, and communicate clearly with stakeholders!

8. Orderly Liquidation

Finally, Orderly Liquidation is a pragmatic solution for winding down operations while maximizing returns for stakeholders.

This approach involves selling off assets in a systematic manner to repay debts and distribute remaining funds to shareholders. While not typically the preferred exit strategy, Orderly Liquidation can be necessary in cases where other options are impractical or unavailable.

The Small Business Administration (SBA) reported that around 50% of small businesses close within their first five years of operation, with many opting for liquidation as the exit route. In 2021, approximately 23% of business closures were due to liquidation.

Orderly Liquidation is a viable exit strategy, especially in challenging economic environments or when faced with insurmountable obstacles.

In Conclusion…

Don’t assume that selling your business is the only way out!

Whether it is passing the torch to family members, empowering employees through ownership, or tapping into public markets through an IPO, each approach offers unique advantages and considerations. By understanding the nuances of each strategy—from management buyouts to orderly liquidation—you can make informed decisions that align with your vision for the future.

Related Articles

Get A Grip Roundtable

Does This Sound Familiar? Your business isn't as efficient or profitable as you'd like. You’re putting in the hours but not seeing the results you want. You’re stuck. You know your business has potential, but you're unsure how to take it to the next level. You’re...

Fixing an Unprofitable Business Model

Uncover expert tips on reevaluating pricing, cutting costs, enhancing efficiency, diversifying revenue streams, and more.

How the Four Types of Intellectual Property Contribute Value to Your Company

Intellectual property is a highly valuable type of intangible business capital. It can take 1 of 4 forms: trademarks, patents, copyrights, or trade secrets.

Your company must take the time and invest the resources to protect its intellectual property! Learn why IP’s are so important, and how you can protect yours in our latest article.

Need Fresh Eyes On Your Business?

We offer complementary consultations to help you identify the areas where you could most quickly and easily improve your business’s performance, value, and profitability. Request one today.