If you’re a business owner, you focus on profit, but that can sometimes distract you from the need to improve business stability. When the pandemic hit in 2020, it kicked off a series of crises that we’re still recovering from today. These crises have been a stark reminder of the importance of prioritizing stability and resilience in business.

Truly strong businesses can withstand disruptions of all kinds – broken supply chains, employee turnover, rising raw materials costs, dramatic shifts in demand, and more. Companies like Netflix and Zoom proved that success is possible in any economic environment – experiencing exponential growth during COVID.

Building a resilient business doesn’t happen automatically – it requires a deliberate effort. The good news? Investing in stability not only extends your business’s longevity but also drives profitability. A stronger foundation isn’t just a safety net – it’s a strategic advantage that enhances both profitability and valuation.

While the goal is to be a thriving company, stability ensures you can stay in the game longer.

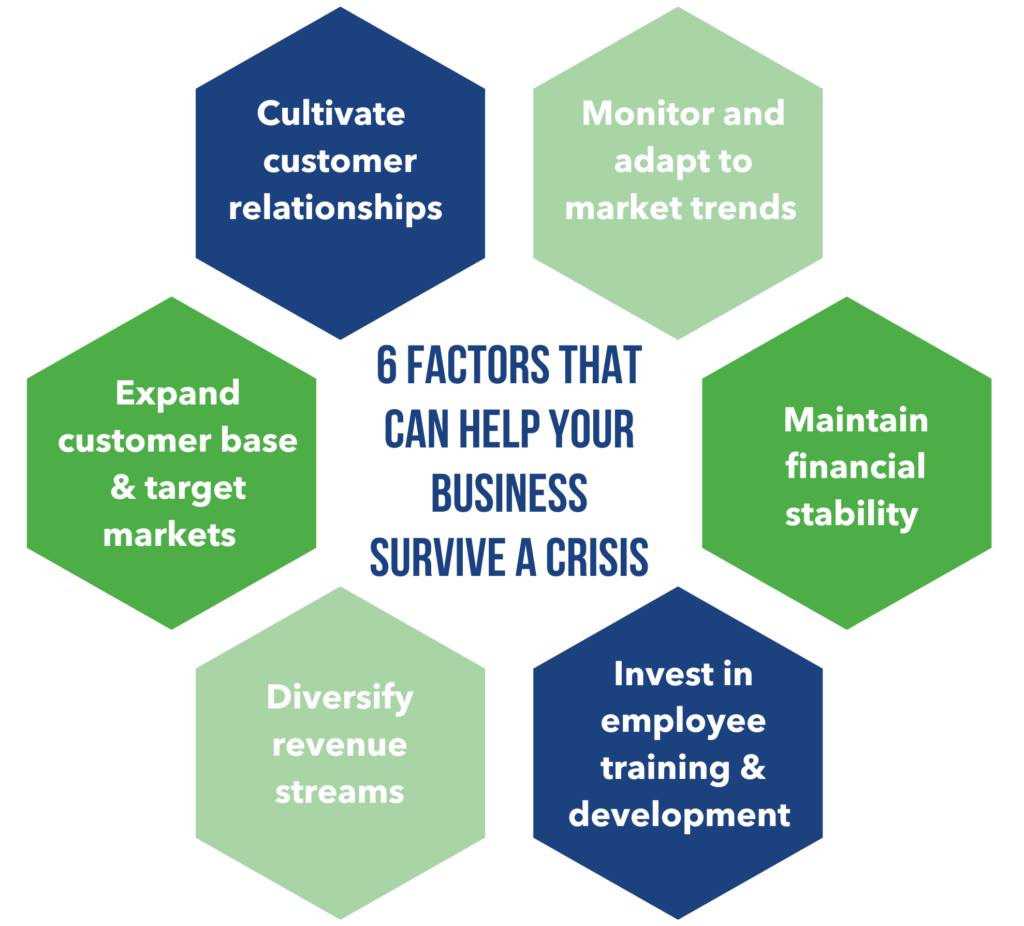

Strengthening your business will help it withstand both the once-in-a-lifetime and everyday challenges. And the key to that? These six factors will help you survive, scale, and thrive — no matter the crisis.

- Diversify revenue streams

- Broaden your customer bases

- Cultivate strong customer relationships

- Stay agile & adapt

- Maintain financial health

- Invest in your people

1. Diversify Revenue Streams

Relying on a single source of revenue leaves your business vulnerable to market fluctuations and shifting customer preferences. We worked with a healthcare company that primarily serviced a handful of large healthcare facilities. When those facilities were acquired by a larger operator, contracts were moved elsewhere – revealing that their perceived diversification was merely an illusion.

To enhance stability, explore ways to generate revenue from multiple sources, whether through new markets, different customer segments, or expanded product or service offerings.

We’ve helped clients repurpose existing products and services into new bundles, giving existing prospects more choices while creating additional revenue streams. We also guide businesses in identifying margin-enhancing opportunities for underutilized or stagnant offerings.

Another key strategy is expanding target markets. For example, we advised a company that was heavily focused on the tech sector to branch into healthcare and financial services. This diversification smoothed out revenue across industries with different budget cycles, reducing overall risk.

2. Broaden Your Customer Bases

You may have heard of “customer concentration.” If your business relies too heavily on a small number of customers for revenue, it increases your risk if those change or disappear. The same applies if the bulk of your sales come from a single market niche.

To reduce risk and improve stability, broaden your customer base and target markets. Consider:

- Conducting market research to identify new customer segments

- Launching marketing campaigns to reach new audiences

- Exploring partnerships with other businesses to access their customer base

3. Cultivate Strong Customer Relationships

Customer loyalty is a powerful asset. Strong relationships with customers create a more stable and resilient business. Behind every business are decision-makers. When you take the time to understand their needs, provide exceptional service, and maintain open communication, you build trust and long-term loyalty – reducing the risk of losing key clients.

Encourage your team to humanize customer interactions and invest time in building relationships. Implement retention strategies such as loyalty programs or personalized offers to foster repeat business and strengthen customer connections.

4. Stay agile & adapt

While consistency is important, avoiding stagnation is equally critical. Follow market trends, industry developments, and emerging technologies. Regularly assess competitor strategies and adjust your business strategy as needed.

We recently worked with two clients to conduct a market survey to determine competitor pricing. This information allowed them to calculate their ability to raise prices, and by how much – without losing competitiveness.

By staying proactive and responsive to changes, you can position your business to capitalize on new opportunities and build your reputation as an industry leader.

5. Maintain Financial Health

Long-term success starts with financial stability. To stay on top of this, you need qualified finance professionals to provide guidance and expertise. We’ve covered key financial practices in other articles, but here are a few essential practices:

- Implement sound financial management practices, including budgeting, cash flow forecasting, and cost control measures.

- Stay on top of your books – close each month on time and review your financial reports with an expert.

- Build up cash reserves or lines of credit to weather unexpected financial challenges.

- Regularly review and adjust pricing structures to ensure profitability and maintain a healthy financial position.

6. Invest in Your People

One of the biggest challenges businesses are facing right now is the shortage of qualified people. Those businesses that took their employees for granted are now seeing what happens when those human resources have no loyalty or connection to the company.

The cost of hiring and training a new employee can be two to three times their annual salary – far more than investing in retention. To build a stable workforce:

- Offer training and development programs to enhance their skills, knowledge, and adaptability.

- Provide fair compensation and meaningful rewards – don’t cut corners or rely solely on negative consequences.

- Foster a culture of engagement and recognition to improve retention and performance

Well-trained and motivated employees are better equipped to handle challenges, adapt to changes, and contribute to the business’s overall stability.

More Insights on Business Success

Explore more articles for strengthening your business and planning a successful exit.

Related Articles

Build & Beware: What it might cost you to sell your business

You Just Sold Your Business for Millions – So Why Isn’t That in Your Bank Account? The papers are signed. The deal is closed. After years of hard work, you’re ready to celebrate your big payday. But as you finalize accounts and tie up loose ends, you realize the...

Eight Ways to Exit Your Business

When it comes to exiting a business, most people assume there is only one way out: sale. But actually, there are 8 distinct ways to exit a business. Before considering your next move, it’s crucial that you understand each of these options to determine which is best...

Navigating Payroll Taxes

Tax deadlines are creeping up, demanding your attention and time. You’re still busy making sure things run smoothly day-to-day; filing business taxes can feel like the last complication you want to deal with.

Cashflow: Why you need it, and how to have money in the bank for your next busy season

Gain insights from industry experiences and expert guidance to optimize your financial strategies.

If You Don’t Have a Leadership Transition Plan, Your Exit Could Fail

If you Don’t Have a Leadership Transition Plan, Your Exit Could Fail

Need Fresh Eyes On Your Business?

We offer complementary consultations to help you identify the areas where you could most quickly and easily improve your business’s performance, value, and profitability. Request one today.

0 Comments