Ask a business owner over the age of 50 when they plan to transition or exit their business, and you’ll get one of two answers:

- a blank stare, or

- “I’ll work another 5-10 years and call it quits.”(If you ask this person again in another 5-10 years, you’ll likely get the same answer

The bottom line is the same – most business owners lack a plan for leaving their business. In this article, we’ll describe what an effective exit plan looks like.

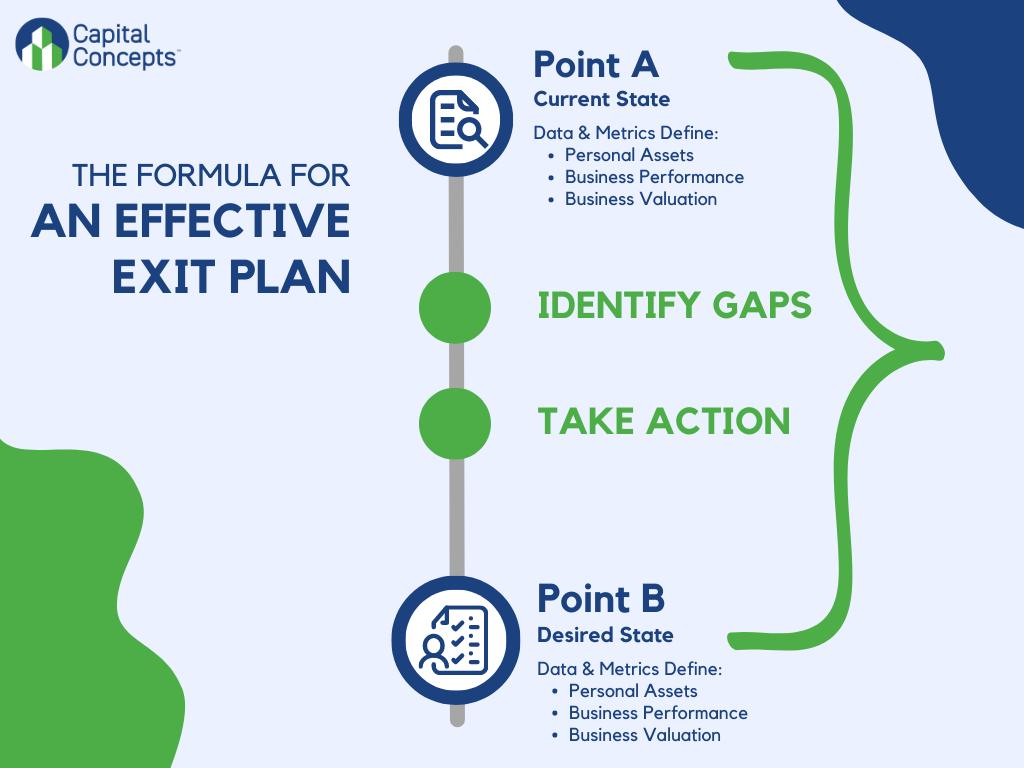

The Purpose of the Exit Plan: Get from Point A to Point B

It’s a mistake to assume that pure organic growth will get you or your business where they need to be when you exit the business. Sometimes, that just isn’t possible. Relying on organic growth alone to grow your business might take 100 years, and you just don’t have that kind of time.

To avoid this mistake, you need an effective exit plan. This plan includes:

- Data and metrics that define Point A – your current status (both personally and in the business

- Data and metrics that define Point B – where you need to be to exit

- A measurable and achievable plan to get from point A to B

In our ongoing series on exit planning, we’ve recommended business owners take stock of how they’re using their time in business and in their personal life. This is part of defining point A – status today. We’ve also advised planning and starting activities desired for the next chapter in life. This is part of defining point B – future status. More factors remain in this equation.

Point B – Where Do You Want To Be?

As Steven Covey says, plan with the end in mind. First, determine a point in time you want the option to exit – your point B. In addition to defining what you want your life to look like, you need the financial resources to fund it. For this, you’ll need expert advisors to weigh in. These include Certified Exit Planning Advisors (CEPA(R)s) like our team at Capital Concepts USA, wealth managers, estate planners, attorneys, and tax accountants.

Determining when you can exit depends on your business’s state and your goals for the future. Whether you plan to maintain a second home, travel internationally, become a semi-professional golfer, or move into an in-law suite to help care for the grandkids will significantly alter your financial needs. Smart financial planners will help you:

- Estimate your annual expenses.

- Forecast the total amount you need based on your lifespan

- Establish a budget that you must fund

- Look at all of your financial assets, from the business to 401ks to stocks to real estate investments, and determine how to make them support you.

- Identify how much you need out of your business and a reasonable time frame to reach that goal.

Point A – Where Are You Today?

Next, you must accurately assess your current situation – point A. You can’t create an effective exit plan without knowing the gap between where you are and where you want to be. Business owners frequently overestimate what their business is actually worth and underestimate how ready it is to sell. Getting real information is critical if you want to exit successfully.

As Certified Exit Planning Advisors, we assess where your business is today, asking questions including:

- Is it possible to determine a value of the business, and if so, what is that value?

- How ready is it to sell?

- What are the strengths and opportunities? How do we quantify these?

- What are the weaknesses and threats? How do we quantify these?

The Effective Exit Plan

The answers to the questions above are essential to defining exactly what’s needed to increase and maintain the value of your business at the level you need. As the Exit Planning Institute says, you must “know your gaps” (view/print their PDF here or by clicking the image) before you can fill them. Something is missing between Point A and Point B; an effective exit plan spells out how to fill those gaps and reach your successful exit.

Lorne Greenfield, CEPA and founder of Capital Concepts, says, “Exit Plans are highly customized because each business and situation is different. They include a readiness assessment to define deficiencies and what needs to be shored up to ensure the best possible value.”

Contents of an Effective Exit Plan

Your exit plan will detail how to improve your profit margins dramatically, make your business function without you, and demonstrate consistent performance. Steps might include:

- Documenting processes

- Finding and fixing inefficiencies

- Helping you find the right people for the work needed

- Creating predictable sales and pricing models

- Getting your books current

- Finding capital to smooth out cash flow and invest in improvements

- Holding teams accountable for reaching goals

In our next several articles, we’ll discuss how to determine the value of a business, improve that value, and get the highest value from your business when you exit.

Have you read our previous articles in this series on Exit Planning?

Related Articles

Get A Grip Roundtable

Does This Sound Familiar? Your business isn't as efficient or profitable as you'd like. You’re putting in the hours but not seeing the results you want. You’re stuck. You know your business has potential, but you're unsure how to take it to the next level. You’re...

Eight Ways to Exit Your Business

When it comes to exiting a business, most people assume there is only one way out: sale. But actually, there are 8 distinct ways to exit a business. Before considering your next move, it’s crucial that you understand each of these options to determine which is best...

The Benefits of Planning for Life Outside of Work

How long has it been since you did something just for the fun of it? What is on your list of “Things I’ll Do Someday When I Have Time”? You may think that you need to wait to start checking things off that list, but that’s a mistake.

There’s more to life than work, and it’s the things you enjoy in your leisure time that make you a well-rounded and happy human being. In this article, we invite you to start exploring and experimenting to find enjoyable and fulfilling activities outside of work and give some practical suggestions for how to do it.